What is the Denim Capital of the World?

From classic jeans to luxury streetwear, denim has evolved from workwear to a fashion essential that spans the globe. But while styles change, one question remains crucial for brands and sourcing teams: Where does the majority of the world’s denim actually come from?

The city of Xintang in Guangdong Province, China, is widely recognized as the “Denim Capital of the World.” It produces over one-third of the global supply of denim fabrics and jeans, serving major fashion brands across the U.S., Europe, Asia, and beyond. Its unmatched infrastructure, deep supply chain integration, and competitive pricing make it the most dominant hub for denim production globally.

At the heart of Xintang’s rise is not just volume, but scale — thousands of textile and garment factories, dyeing houses, wash mills, and finishing plants operate in a tightly connected ecosystem. While sustainability challenges have surfaced, the region is adapting, with many facilities investing in green production and automation to remain globally competitive.

A denim startup in California increased gross margin by 28% after switching from a Turkish supplier to a vertically integrated Xintang-based manufacturer — all without compromising on quality.

In this article, we’ll explore why Xintang leads the denim world, how it compares to other contenders like India or Bangladesh, and what this means for global sourcing professionals in 2025 and beyond.

1. What City or Region Is Commonly Known as the Denim Capital of the World?

Xintang, located in Guangzhou’s Zengcheng District in China’s Guangdong Province, is globally recognized as the Denim Capital of the World due to its massive output, dense supply chain, and export volume.

Why Xintang Dominates the Denim World

● Overview of Xintang’s Denim Economy

- Over 60% of China’s jeans exports come from Xintang.

- The region houses over 4,000 textile enterprises, including 1,200 denim-focused factories.

- Xintang produces over 300 million pairs of jeans annually.

- According to reports from the China National Textile and Apparel Council, Xintang’s denim production covers over 40 square kilometers.

● Historical Growth

- Xintang’s denim industry began in the 1980s as a local township textile business.

- By the early 2000s, it had become a global export powerhouse, attracting buyers from Levi’s, Wrangler, H\&M, and Zara.

● Strategic Advantages

- Located close to Shenzhen, Hong Kong, and major ports, Xintang benefits from:

- Fast shipping

- Efficient logistics

- Access to international trade channels

● Integrated Ecosystem

| Supply Chain Component | Description | Notes |

|---|---|---|

| Fabric Mills | Weaving & dyeing raw denim | Large-scale vertical integration |

| Garment Factories | Cut, sew, and finish jeans | OEM/ODM capacity for global brands |

| Washing & Finishing | Stone wash, enzyme, laser finishes | Eco-tech emerging since 2019 |

| Packaging & Export | Final steps handled locally | Lower transport costs |

A German fashion wholesaler sourced 14oz mid-wash denim from Xintang and cut production lead times by 40% compared to Southeast Asian suppliers, thanks to Xintang’s dense and responsive supply network.

2. Why Is Xintang, China Often Referred to as the Global Center of Denim Manufacturing?

Xintang earns its “denim capital” title due to its scale, integration, and ability to serve global fast fashion and premium brands alike — combining mass production with trend adaptation.

Key Reasons Behind Xintang’s Global Leadership

● Production Capacity and Output

- Annual Output: Over 800 million meters of denim fabric are produced annually in Xintang.

- Jeans Production: Over 300 million pairs of jeans shipped globally every year.

- Market Share: Accounts for more than one-third of the world’s jeans exports.

| Metric | Xintang Benchmark |

|---|---|

| Annual Denim Fabric Output | 800 million meters |

| Jeans Manufactured | 300+ million pairs/year |

| Factory Count | 1,200+ denim-specific factories |

● Vertical Integration

- Many Xintang manufacturers are vertically integrated — they spin, dye, weave, cut, wash, sew, and pack in-house.

- This reduces lead times and simplifies quality control for global buyers.

● Workforce and Skills

- Over 200,000 workers are employed in Xintang’s denim industry.

- Decades of experience make the workforce highly specialized in denim-specific processes like:

- Indigo rope dyeing

- Reactive finishing

- Abrasion-resistant enzyme washing

● Global Client Base

- Supplies major brands like Uniqlo, Levi’s, Gap, H\&M, PVH, and private label clients from Europe, North America, and Latin America.

- Xintang’s factories also supply smaller brands and e-commerce sellers, thanks to their flexible MOQ structures.

An Australian DTC denim label scaled its inventory by working with a mid-size Xintang supplier offering low MOQs, free design services, and digital wash previews — features difficult to find in older European mills.

3. How Does Xintang Compare to Other Denim-Producing Regions Like Bangladesh, India, and Pakistan?

Xintang surpasses other denim-producing countries in terms of integrated supply chain, production speed, and flexibility, while countries like Bangladesh, India, and Pakistan compete through labor cost efficiency, volume capacity, and growing sustainability practices.

Comparative Analysis of Major Global Denim Hubs

● Production Volume and Factory Integration

| Country/Region | Estimated Annual Output (Jeans) | Vertical Integration | Key Strengths |

|---|---|---|---|

| Xintang, China | 300+ million pairs | Strong | Speed, flexibility, OEM/ODM, low MOQ |

| Bangladesh | 250+ million pairs | Medium | Low labor cost, mass production |

| India | 200+ million pairs | Growing | Domestic raw cotton supply, versatile fabric |

| Pakistan | 180+ million pairs | Strong in textiles | Competitive pricing, strong textile base |

| Turkey | 100+ million pairs | Strong | Close to Europe, premium finishes |

● Lead Time and Responsiveness

- Xintang: Shortest lead times due to proximity of mills, dye houses, and garment factories. Ideal for fast fashion and seasonal changes.

- Bangladesh & India: Slightly longer lead times due to more fragmented supply chains. Better suited for planned large-volume production.

- Turkey: Shortest for European buyers but with higher base cost.

● Labor Cost and Pricing

- Bangladesh and Pakistan offer the lowest labor costs globally, making them ideal for budget-oriented mass orders.

- Xintang’s prices are moderately higher, but brands pay for speed, capacity, and customization.

- India has diverse pricing tiers, depending on region and mill scale.

● Fabric Innovation and Sustainability

- Turkey and some Indian mills (like Arvind) lead in sustainable R\&D, investing in ozone washing, laser finishing, and waterless dyeing.

- Xintang mills are catching up by upgrading to zero-discharge dyeing and closed-loop water systems, though some environmental challenges remain.

A Canadian brand tested two suppliers:

- Xintang: Delivered 10,000 units of stone-washed jeans in 22 days with 98% accuracy.

- Bangladesh: Delivered the same order in 36 days at 20% lower cost — but with 5% fabric inconsistency and 8% shipment delay due to customs bottlenecks.

4. What Is the Annual Denim Output of the Denim Capital Compared to Global Totals?

Xintang’s annual denim output represents over one-third of the global jeans supply, producing more than 800 million meters of denim fabric and 300 million finished jeans every year — the largest of any single region in the world.

Xintang’s Output in the Global Context

● Global Denim Market Overview

According to the 2024 Global Denim Industry Report by Grand View Research:

- Global denim fabric production: \~2.2 billion meters/year

- Global jeans production: \~7.1 billion pairs/year

| Region | Denim Fabric Output (meters/year) | Share of Global Fabric Production |

|---|---|---|

| Xintang, China | 800 million | 36% |

| India | 480 million | 22% |

| Bangladesh | 400 million | 18% |

| Pakistan | 350 million | 16% |

| Turkey | 120 million | 5% |

● Market Segments Served by Xintang

- Mass-market: Fast fashion (e.g., H\&M, Zara, Primark)

- Mid-tier: Retailers with private labels (e.g., Target, Uniqlo, American Eagle)

- Premium: Boutique brands with custom washes, raw denim, and stretch selvedge

● Growth Projections

- Xintang’s denim exports are projected to grow 5.5% annually through 2028, driven by:

- Increased automation

- Expanding eco-friendly dyeing capacity

- Surge in low-MOQ orders from DTC brands

In 2023, a European denim wholesaler reported a 12% increase in profit margin after shifting 70% of its denim fabric sourcing to Xintang. The switch allowed them to reduce rejections and increase speed-to-market during trend shifts.

5. Which Major Brands and Buyers Source Denim from the Denim Capital?

Leading global brands—including fast fashion giants, mid-tier retailers, and premium denim labels—source from Xintang due to its unmatched production scale, cost efficiency, and ability to deliver consistent quality at speed.

Xintang’s Role in the Global Denim Supply Chain

● Fast Fashion Giants

- Zara, H\&M, Primark, and Shein rely heavily on Xintang’s vertically integrated supply chains to meet the fast turnaround times of trend-driven collections.

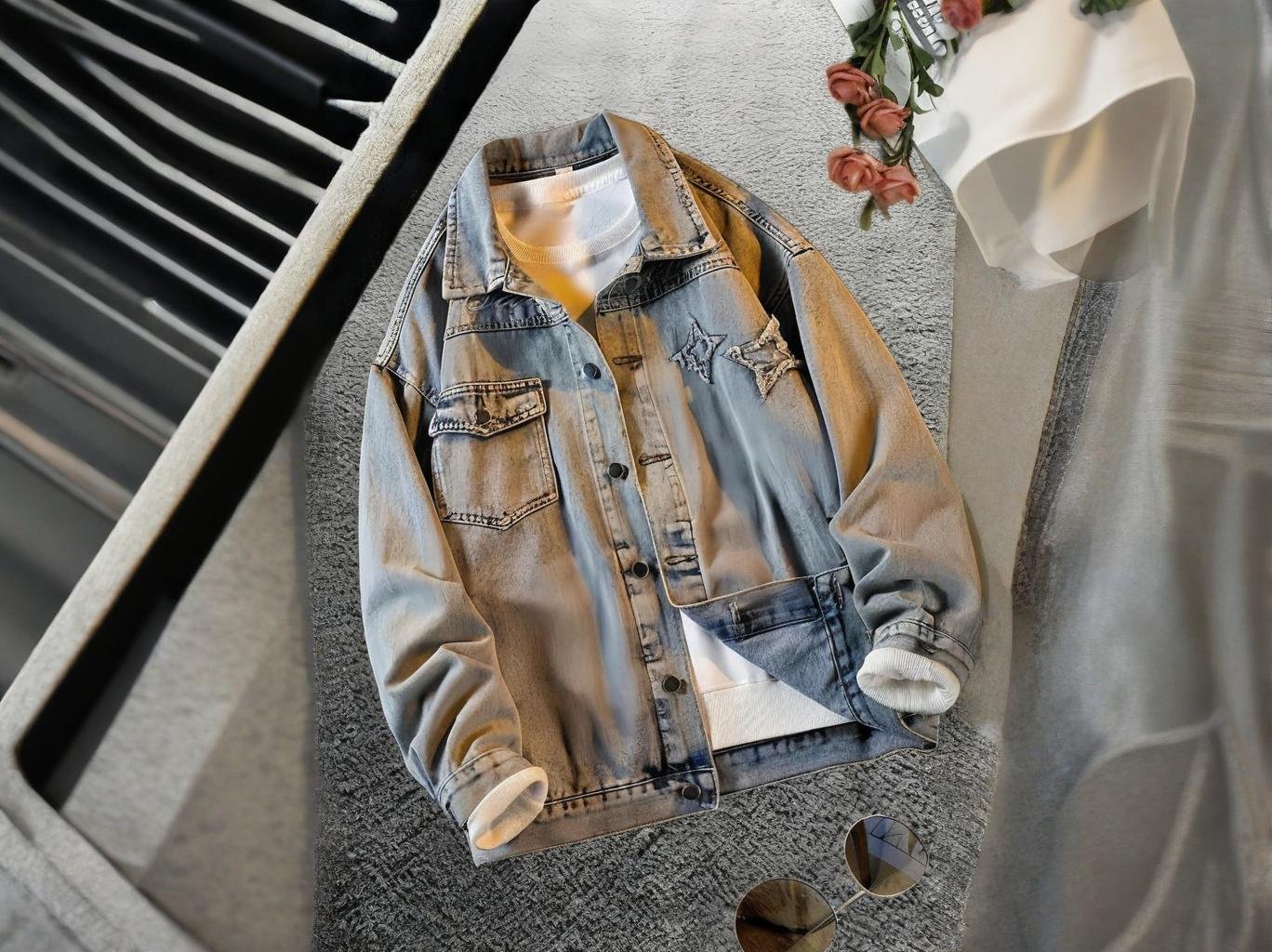

- These brands often outsource high-volume basic denim styles, such as skinny jeans, boyfriend fits, and cropped denim jackets.

| Brand Name | Denim Type Sourced from Xintang | MOQ Flexibility | Lead Time |

|---|---|---|---|

| H\&M | High-volume, enzyme-washed jeans | High | 20–30 days |

| Zara | Seasonal capsule lines (e.g. frayed hem, bleach wash) | Medium | 14–21 days |

| Shein | Stretch denim for Gen Z markets | Low | 10–15 days |

● Private Label and Retail Chains

- American retailers like Target, Walmart, and Old Navy source denim in bulk through intermediaries or local buying offices based in Guangzhou or Shenzhen.

- Xintang’s manufacturers often provide OEM/ODM services, allowing brands to customize design, color, cut, and wash while keeping production costs low.

A UK high street brand sourced 20,000 pairs of wide-leg jeans from a Xintang supplier. They offered 3 iterations of wash samples, handled custom woven labels, and delivered within 25 days—all at \$1.50 per unit cheaper than their Turkish supplier.

● Premium and Emerging Brands

- While known for high-volume orders, Xintang also caters to premium brands and indie DTC startups through small-batch services with low MOQs and custom finishes.

- Stretch selvedge denim, vegan patching, and ozone-washed raw denim are increasingly being produced for clients seeking unique positioning.

● E-commerce-Focused Startups

- Amazon and Shopify-based denim labels often choose Xintang due to its support for:

- Free tech pack development

- On-demand sampling

- Inventory drop-shipping

For smaller brands, partnering with mid-sized Xintang suppliers can offer better attention, low sampling costs, and flexible payment terms, compared to mega-factories that prioritize volume.

6. How Do Environmental and Sustainability Practices Vary in the World’s Top Denim Centers?

Xintang, once criticized for industrial pollution, is now investing heavily in sustainability upgrades. However, environmental practices still vary greatly across global denim hubs—making it essential for B2B buyers to vet certifications and wastewater management.

Comparing Eco-Initiatives in Leading Denim Regions

● Xintang’s Environmental Transformation

In 2010, Xintang faced international backlash due to its role in contaminating the Dong River with indigo dyes, chemicals, and textile waste. Since then, major reforms have been introduced:

| Sustainability Metric | Status in Xintang (2024) |

|---|---|

| Centralized wastewater system | ✔ Implemented in 2016 |

| Dyeing effluent treatment | ✔ Mandatory for certified mills |

| Green certifications | ✔ OEKO-TEX®, GOTS, ISO14001 available |

| Energy-efficient equipment | ✔ Upgrades in modernized mills |

| Closed-loop water reuse | ⚠️ Partial implementation, ongoing |

Denim factory Guangdong Chuangxin Textile, based in Xintang, reduced water consumption by 38% in 2023 using low-liquor dyeing machines and biological filtration.

● Sustainability in Other Denim Hubs

| Region | Green Highlights | Areas to Improve |

|---|---|---|

| Turkey | EU-aligned standards, ozone/laser technology | Higher production costs |

| India | Waterless dyeing (e.g., Arvind Mills), recycling | Inconsistent across smaller mills |

| Bangladesh | LEED-certified factories, solar installations | Limited access to eco dyeing tech |

| Pakistan | GOTS/BCI cotton sourcing, strong in fabric reuse | Challenges with small-unit traceability |

● Certifications to Watch

- OEKO-TEX® Standard 100: Ensures fabric is free of harmful chemicals.

- GOTS (Global Organic Textile Standard): Verifies use of organic cotton and sustainable production methods.

- ZDHC (Zero Discharge of Hazardous Chemicals): Monitors chemical use and effluent treatment.

- Higg Index: Environmental scoring system adopted by premium brands.

Always request:

- Water recycling rate (%)

- Chemical management protocol

- Emission reports

- Valid third-party certifications (not expired)

Buyers aiming for ESG compliance or transparency in fashion audits will find that top-tier Xintang suppliers are now equipped to provide necessary documentation, especially those working with European or North American brands.

7. Is the Denim Capital of the World Shifting Due to Global Supply Chain Changes?

While Xintang remains the leading global denim hub, shifting labor costs, trade tensions, and sustainability demands are prompting brands to diversify their sourcing strategies—raising questions about whether Xintang can retain its crown in the next decade.

Will Xintang Stay on Top?

● Geopolitical Pressures

- The U.S.–China trade war, which saw tariffs as high as 25% imposed on some textile categories, forced many brands to rethink their reliance on China-based manufacturing.

- EU import policies, such as carbon border taxes, may soon favor sourcing from Turkey or North Africa over Asia, including China.

| Factor | Impact on Xintang | Notes |

|---|---|---|

| U.S.–China Tariffs | Higher cost for U.S. buyers | Some moved sourcing to Bangladesh |

| EU Carbon Regulations | Pressure to disclose emissions | European buyers seek low-impact mills |

| Labor Cost Increases | 8–10% rise per year in Guangdong | Southeast Asia remains cheaper |

● Rise of Alternatives

- Bangladesh and Pakistan are increasing denim capacity with modern facilities, sustainable washing, and government-backed textile incentives.

- Vietnam and Indonesia are emerging as attractive sourcing regions due to FTA advantages, though denim production there is not yet as mature.

● Xintang’s Strategic Response

To remain competitive, Xintang manufacturers are:

- Investing in AI-driven fabric inspection

- Adopting blockchain traceability tools

- Targeting low-MOQ international buyers via Alibaba and Made-in-China platforms

- Expanding their sustainability certifications to serve premium brands

Market Forecast (2025–2030): While Xintang will likely retain its leadership in terms of scale and infrastructure, a multi-sourcing strategy will become the norm for global brands. This means Xintang may remain the production center, but brands will hedge risk with suppliers in Turkey, Vietnam, and South Asia.

8. What Should B2B Buyers Consider When Sourcing Denim from the Denim Capital?

When sourcing from Xintang, B2B buyers should evaluate factory capabilities, compliance records, communication fluency, and MOQ flexibility. Verifying sustainability credentials and conducting small-batch testing are also critical to mitigating risk.

A Smart Sourcing Checklist for Denim Buyers

Evaluate Supplier Profiles

- Check if suppliers are vertically integrated, which reduces risk and speeds up production.

- Look for clear profiles with detailed tech packs, sampling timelines, and photo references of past work.

Request Documentation

Always ask for:

- Factory audit reports (BSCI, SEDEX, WRAP)

- Third-party certifications (GOTS, OEKO-TEX®, RCS, ISO 14001)

- Environmental metrics (water usage, dye type, recycling methods)

| Document Type | Why It Matters |

|---|---|

| OEKO-TEX® Certification | Verifies non-toxic, consumer-safe production |

| GOTS Certification | Ensures organic cotton and ethical processing |

| BSCI/WRAP Audit Report | Confirms labor and social compliance |

Start with Samples or Small MOQ

- Many Xintang suppliers offer 50–100 piece MOQs for new buyers.

- Request washed and unwashed fabric samples, along with shrinkage test results.

- Use pre-shipment inspections to avoid surprise quality issues.

A U.S.-based DTC brand ordered 150 units of raw denim jeans from a mid-size Xintang mill to test logistics and fabric quality. After positive customer feedback and zero returns, they scaled to 2,000 units and signed an annual production agreement—gaining 12% cost savings through loyalty discounts.

Understand Lead Times and Flexibility

- Typical production time: 15–30 days

- Sampling: 5–10 days

- Logistics: Nearby ports like Shenzhen, Hong Kong, and Guangzhou offer both FOB and DDP options

Use Platforms for Supplier Verification

- Check suppliers on:

- Alibaba Verified and Made-in-China Audited Supplier

- Global Sources with RFQ tool access

- Trade shows like Canton Fair or Intertextile Shanghai

Why Xintang Remains at the Core of Global Denim

Xintang is still the undisputed denim capital of the world—a powerhouse of production, innovation, and fast-paced customization. Its ability to serve brands of all sizes, from fashion giants to emerging DTC startups, makes it a crucial partner in today’s denim supply chain.

But as buyers grow more conscious about sustainability, compliance, and logistics resilience, sourcing decisions must be made with greater strategic insight. A diversified approach that includes Xintang—while also exploring Pakistan, Turkey, or Vietnam—can provide the agility and risk management modern brands demand.

Work with SzoneierFabrics: Your Trusted Denim Sourcing Partner

At SzoneierFabrics, we offer:

- Custom denim fabric development in stretch, selvedge, raw, organic, or recycled styles

- Low MOQ starting from 100 meters

- Fast sampling (5–7 days) and reliable lead times (15–25 days)

- Certified production with OEKO-TEX®, GOTS, and RCS standards

- Full support for private label and OEM/ODM programs

Looking to source premium denim from China with global standards? Contact SzoneierFabrics today for a custom quote, free fabric swatch kit, or sampling trial — and let’s co-create your next denim bestseller.

Can't find the answers?

No worries, please contact us and we will answer all the questions you have during the whole process of bag customization.

Make A Sample First?

If you have your own artwork, logo design files, or just an idea,please provide details about your project requirements, including preferred fabric, color, and customization options,we’re excited to assist you in bringing your bespoke bag designs to life through our sample production process.