You know that feeling when you’ve scoped out the perfect fabric for your next collection—only to see the price tag blow your budget out of the water? From cotton classics to high-tech synthetics, material choice can swing bulk order costs by 50% or more, making it the single biggest lever for sourcing managers. Fabrics fall into four primary categories—natural, synthetic, blended, and nonwoven—and each group carries its own cost drivers, from raw‐material expenses and processing complexity to finish applications and MOQ requirements.

Imagine a home‐textiles startup that switched from long-staple cotton sateen to a mid-count cotton–polyester blend: they cut fabric spend by 30% without guests noticing any drop in softness—showing just how strategic material swaps can save real money. Stick around: we’ll break down the major fabric families and reveal where your dollars go.

What Are the Major Fabric Categories That Drive Bulk Pricing?

When you place a bulk fabric order, you’re really choosing among four cost buckets: natural fibers (e.g., cotton, linen, silk), synthetic textiles (e.g., polyester, nylon, acrylic), fiber blends (e.g., poly-cotton, wool-nylon), and nonwovens (e.g., spunbond polypropylene, meltblown filter media). Natural fibers often carry 20–50% premiums due to cultivation and harvesting costs; synthetics leverage economies of scale but add polymerization and extrusion expenses; blends inherit both sets of costs plus blending steps; nonwovens skip weaving/weaving steps but require costly forming and bonding processes.

Comparing Price Drivers Across Fabric Categories

Natural Fibers

- Raw Material: Harvested from plants or animals—cotton (\$1.50–\$3.00/kg), linen flax (\$3.00–\$5.00/kg), silk (\$20–\$30/kg).

- Processing: Ginning, combing, and fine spinning add \$0.50–\$1.00/kg in mill costs.

- Total Impact: Final fabric prices range \$3.50–\$12.00/yard for common weights.

Synthetic Fibers

- Raw Material: Petrochemical feedstocks—polyester (\$1.00–\$2.00/kg), nylon (\$2.00–\$4.00/kg), acrylic (\$2.50–\$3.50/kg).

- Processing: Melt spinning and drawing add \$0.30–\$0.70/kg; dope dyeing can add \$0.50–\$1.00/kg.

- Total Impact: Fabric prices of \$2.00–\$6.00/yard.

Blended Textiles

- Blend Premium: Mixing fibers (e.g., 65/35 poly-cotton) adds \$0.20–\$0.50/kg for blending and compatibility testing.

- Performance Finishes: Wrinkle resistance, antimicrobial finishes add another \$0.20–\$0.60/yard.

- Total Impact: Blended fabrics often sit between \$2.50–\$8.00/yard.

Nonwovens

- Formation: Spunbond, meltblown, or needle-punched processes cost \$1.50–\$3.00/kg in raw formation.

- Bonding: Thermal or chemical bonding adds \$0.30–\$0.80/kg.

- Total Impact: Technical nonwovens range \$1.00–\$5.00/yard, depending on basis weight and specialty treatments.

Cost Breakdown by Fabric Category

| Category | Raw Material Cost (USD/kg) | Processing Cost (USD/kg) | Typical Fabric Price (USD/yard) |

|---|---|---|---|

| Natural | 1.50–30 (cotton to silk) | 0.50–1.00 | 3.50–12.00 |

| Synthetic | 1.00–4.00 | 0.30–0.70 | 2.00–6.00 |

| Blended | (Mixed) | 0.20–0.50 (blend) + finishes | 2.50–8.00 |

| Nonwoven | 1.50–3.00 | 0.30–0.80 | 1.00–5.00 |

Critical Perspectives

- Natural vs. Synthetic Trade-Offs Natural fibers offer premium hand but can strain water or pesticide budgets, whereas synthetics lower costs but raise sustainability questions.

- Blend Complexity Blends can hit mid-range budgets but require testing to ensure compatibility and consistent quality across large orders.

- Nonwoven Versatility Ideal for single-use or technical applications, nonwovens bypass weaving costs but may incur higher bonding and finishing expenses.

- Finish-Driven Costs Specialized finishes can account for 10–20% of fabric price—evaluate if features like water repellency or flame retardance are mission-critical.

Which Natural Fibers (Cotton, Linen, Silk) Command Higher Unit Costs?

Natural fibers often top the cost chart due to agricultural inputs, harvesting complexity, and supply constraints. Silk leads at \$20–\$30 per kilogram, reflecting labor-intensive sericulture and fine filament spinning. Linen (flax) follows at \$3–\$5/kg, owing to multi-step retting, scutching, and hackling processes. Premium cotton variants—like long-staple Pima or Egyptian—range \$2.50–\$4.00/kg, while commodity upland cotton sits at \$1.50–\$2.50/kg. These raw material premiums translate into fabric prices of \$8–\$20 per yard for silk, \$5–\$12 for linen, and \$3.50–\$8.00 for high-end cottons, guiding sourcing decisions for budget versus luxury lines.

Cost Components of Top-Tier Natural Fibers

Silk

- Sericulture: Single cocoon harvesting and careful filament reeled at 20–24 °C adds \$10–\$15/kg.

- Spinning & Weaving: Filament yarns require delicate handling—spinning overhead of \$5–\$8/kg.

- Fabric Impact: Silk charmeuse or habotai weaves retail \$12–\$20 per yard; high-sheen dupioni commands up to \$25.

Linen (Flax)

- Retting & Scutching: Field retting (microbial) or water retting (chemical) costs \$1–\$2/kg for waste management.

- Hackling & Spinning: Separating long fibers adds \$1–\$2/kg in labor.

- Fabric Impact: Mid-weight linen fabrics range \$6–\$12 per yard; washed or slub linens hit the higher end.

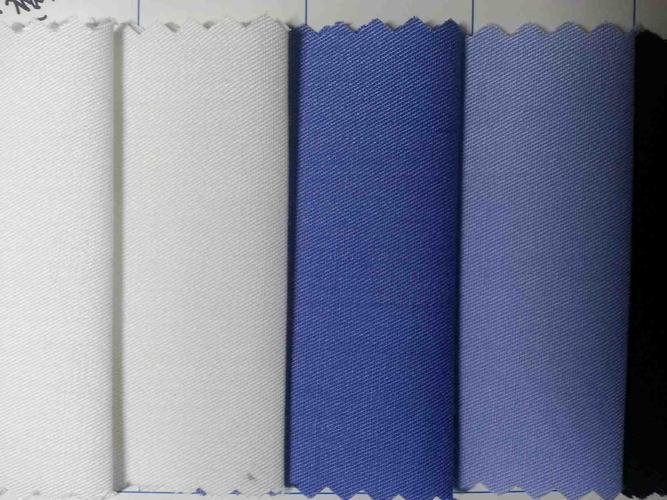

Premium & Commodity Cotton

- Long-Staple Cotton (Pima/Supima/Egyptian): Raw Cost: \$2.50–\$4.00/kg. Processing Premium: Extra ginning and combing add \$0.50–\$1.00/kg. Fabric Impact: High-thread-count cotton sateen and Pima jersey cost \$6–\$10 per yard.

- Upland Cotton: Raw Cost: \$1.50–\$2.50/kg. Processing: Standard combing yields \$0.30–\$0.50/kg. Fabric Impact: Basic cotton poplin and twill sell for \$3.50–\$6.00 per yard.

Natural Fiber Pricing Overview

| Fiber Type | Raw Price (USD/kg) | Processing Overhead (USD/kg) | Fabric Price (USD/yard) |

|---|---|---|---|

| Silk | 20–30 | 5–8 | 12–25 |

| Linen | 3–5 | 2–4 | 6–12 |

| Pima/Egyptian Cotton | 2.5–4.0 | 0.5–1.0 | 6–10 |

| Upland Cotton | 1.5–2.5 | 0.3–0.5 | 3.5–6.0 |

Critical Perspectives

- Luxury vs. Volume While silk and premium cottons justify high margins in luxury markets, budget brands should reserve these for small‐run, high‐value SKUs.

- Supply Chain Volatility Flax and silk supply can fluctuate seasonally; maintain relationships with multiple growers or consider synthetic alternatives for volume stability.

- Sustainability Considerations Organic or regenerative cotton variants carry additional premiums (10–20% above conventional), but boost brand credentials in eco‐driven markets.

- Cost Mitigation Strategies For mid-tier collections, consider cotton–linen slubs or silk blends (e.g., 30% silk, 70% viscose) to impart natural fiber appeal at reduced cost.

How Do Synthetic Materials (Polyester, Nylon, Acrylic) Compare in Bulk Pricing?

Synthetic fibers typically undercut natural counterparts in raw-material cost and benefit from streamlined, large-scale production. Polyester, made from PET resin, costs \$1.00–\$2.00 per kilogram, translating to \$2.00–\$4.00 per yard of basic woven fabric. Nylon, with higher polymerization energy requirements, sits at \$2.00–\$4.00 per kilogram (fabric \$3.50–\$6.00 per yard). Acrylic, designed to mimic wool, ranges \$2.50–\$3.50 per kilogram, yielding \$3.00–\$6.00 per yard fabrics. These lower entry prices make synthetics attractive for high-volume orders, especially when paired with cost-effective finishes.

Evaluating Synthetic Fiber Cost Structures

Polyester (PET)

- Raw Polymer Cost: \$1.00–\$2.00/kg, driven by petrochemical feedstock prices.

- Spinning & Weaving: Melt-spinning and weaving add \$0.30–\$0.70/kg in processing.

- Fabric Impact: Basic polyester plain weave is \$2.00–\$4.00/yard; dope-dyed or textured variants climb to \$5.00–\$7.00.

Nylon (Polyamide)

- Raw Polymer Cost: \$2.00–\$4.00/kg, reflecting higher energy use and monomer costs.

- Processing Premium: \$0.50–\$1.00/kg for high-tenacity or high-elastane formulations.

- Fabric Impact: Nylon taffeta and gabardine run \$3.50–\$6.00/yard; performance-mesh and ripstop can exceed \$8.00.

Acrylic (PAN)

- Raw Polymer Cost: \$2.50–\$3.50/kg, influenced by acrylonitrile feedstock.

- Processing: Solution spinning and drying cost \$0.40–\$0.80/kg.

- Fabric Impact: Acrylic knits and pile fabrics are \$3.00–\$6.00/yard; specialty fire-retardant or UV-stable grades can exceed \$8.00.

Cost-Per-Performance Ratios

- Polyester: Excellent UV and moisture performance vs. cost; ideal for outdoor and activewear.

- Nylon: Superior abrasion and tensile strength justify 20–30% price premium over polyester for heavy-duty uses.

- Acrylic: Wool-like warmth at mid-range cost; lower strength limits industrial applications.

Synthetic Fiber Pricing and Performance Snapshot

| Fiber | Raw Cost (USD/kg) | Processing Cost (USD/kg) | Basic Fabric Price (USD/yard) | Key Advantages |

|---|---|---|---|---|

| Polyester | 1.00–2.00 | 0.30–0.70 | 2.00–4.00 | UV stable, quick-dry |

| Nylon | 2.00–4.00 | 0.50–1.00 | 3.50–6.00 | High strength, abrasion-resistant |

| Acrylic | 2.50–3.50 | 0.40–0.80 | 3.00–6.00 | Wool-like warmth, dye affinity |

Critical Perspectives

- Feedstock Volatility Synthetic prices can fluctuate with oil markets; locking in futures or partnering with integrated suppliers can hedge risk.

- Sustainability Trade-Offs While cheaper, synthetics rely on non-renewable resources and shed microplastics—consider recycled variants (rPET, rPA) at a 10–20% premium.

- Finish Synergies Applying functional finishes (anti-pilling, moisture-wicking) can add \$0.20–\$0.50/yard, but often enhance perceived value enough to offset costs.

- Total Cost Calculations Include end-of-life considerations: synthetic longevity may reduce replacement frequency, balancing environmental and financial factors.

Which Fabric Constructions—Woven, Knitted, Nonwoven—Affect Per-Yard Costs?

Fabric construction has a significant impact on bulk pricing because it dictates machinery requirements, production speeds, and downstream processing. Woven fabrics, produced on looms, require warp and weft preparation and tend to be costlier ( \$3–\$8 per yard for mid-weight plain weaves) due to lower speeds and higher setup costs. Knitted fabrics, made on circular or flatbed knitting machines, spin out at 400–700 meters per hour and cost \$2–\$6 per yard for common jerseys. Nonwovens (spunbond, meltblown, needle-punched) skip yarn formation but use web forming and bonding processes—priced from \$1–\$5 per yard depending on basis weight and bonding method.

Production Dynamics and Cost Drivers

Woven Fabrics

- Process Steps: Warping, sizing, drawing-in, weaving, finishing.

- Speed & Efficiency: 200–400 meters per hour; setup time per design change can be 1–2 hours.

- Cost Drivers: Thread Density: Higher TPI increases machine cycles and energy consumption. Complex Weave: Twill, satin, and jacquard add 5–20% overhead for pattern modules.

Knitted Fabrics

- Process Steps: Yarn feeding, looping, linking, finishing.

- Speed & Efficiency: 400–700 meters per hour; minimal setup when retaining needle arrangements.

- Cost Drivers: Gauge (needles per inch): Finer gauges (26–30) slow speeds by 10–15%. Structure Complexity: Rib, interlock, or jacquard knits add 10–25% to base cost.

Nonwoven Fabrics

- Process Steps: Fiber opening, web formation (spunbond/meltblown), bonding (thermal, chemical, or mechanical), finishing.

- Speed & Efficiency: 800–1,200 meters per hour; continuous process with minimal downtime.

- Cost Drivers: Basis Weight: Heavier weights (>150 gsm) increase raw fiber consumption. Bonding Method: Thermal bonding (lower cost) vs. chemical bonding (+\$0.20–\$0.50 per yard).

Cost & Speed Comparison by Fabric Construction

| Construction | Production Speed (m/h) | Setup Overhead | Basic Cost (USD/yard) | Key Cost Driver |

|---|---|---|---|---|

| Woven | 200–400 | High (looms) | 3.00–8.00 | TPI & weave complexity |

| Knitted | 400–700 | Medium | 2.00–6.00 | Gauge & stitch pattern |

| Nonwoven | 800–1,200 | Low | 1.00–5.00 | Basis weight & bonding type |

Critical Perspectives

- Volume vs. Variety Wovens offer versatility in drape and strength but penalize frequent design changes; knit and nonwoven processes excel in high-volume, minimal-change scenarios.

- End-Use Requirements Nonwovens shine for filtration, hygiene, and geotextiles but lack the hand appeal of wovens or knits—match construction to function, not just cost.

- Equipment Investment Knitting machines have lower changeover costs, benefiting seasonal or small-batch runs—consider for test collections or rapid-turn inventory replenishment.

- Finish Interactions Some finishes (e.g., silicone DWR) adhere differently to knits vs. wovens—pilot small-scale treatments to assess cost‐performance before full orders.

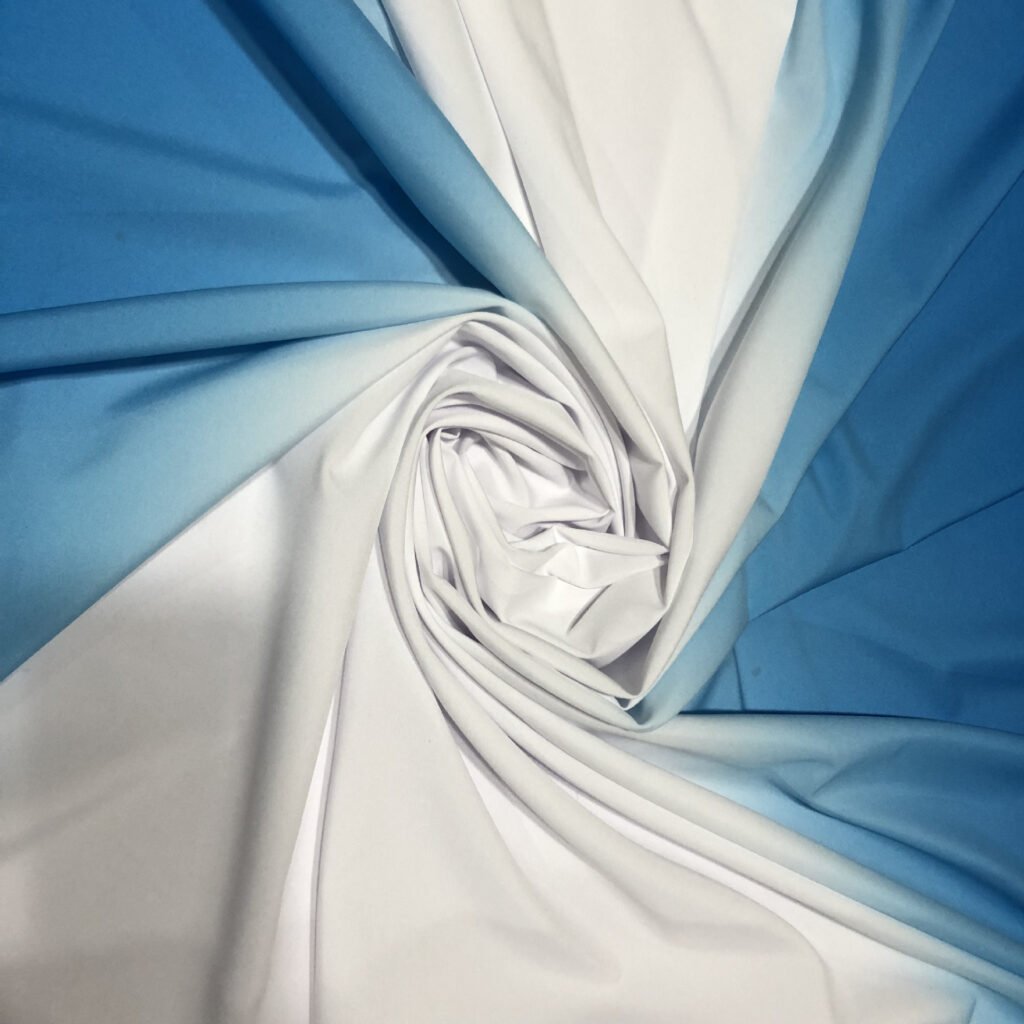

How Do Fiber Blends (Poly-Cotton, Wool-Nylon, Cotton-Lycra) Influence Bulk Order Pricing?

Blending fibers combines properties but also layers cost structures—each component’s raw-material and processing fees contribute to the final per-yard price. Poly-cotton blends (65/35) typically cost 5–10% more than 100% polyester but 10–15% less than 100% cotton, landing around \$3–\$6 per yard. Wool-nylon blends (80/20) add 20–30% to base wool fabric prices, running \$8–\$15 per yard, while cotton-lycra stretch blends (98/2) carry a minor 3–5% premium over pure cotton—about \$4–\$7 per yard—making them cost-effective for performance wear.

Cost Components and Trade-Offs in Common Blends

Poly-Cotton (CVC 65/35)

- Raw Materials: Cotton: \$1.50–\$2.50/kg Polyester: \$1.00–\$2.00/kg

- Blend Cost Impact: 65% cotton + 35% polyester yields raw cost of \~\$1.30–\$1.85/kg—midpoint pricing.

- Processing Overhead: Blending lines and dual-dye processes add \$0.20–\$0.40/kg.

- Fabric Pricing: \$3–\$6 per yard, offering cotton’s comfort with polyester’s durability at reduced cost.

Wool–Nylon (80/20)

- Raw Materials: Wool: \$8–\$12/kg Nylon: \$2–\$4/kg

- Blend Cost Impact: Weighted raw cost \~\$6.8–\$10.4/kg.

- Processing Overhead: Blending and specialized spinning add \$1.00–\$2.00/kg.

- Fabric Pricing: \$8–\$15 per yard—premium price justified by insulation and abrasion resistance.

Cotton–Lycra (98/2)

- Raw Materials: Cotton: \$1.50–\$2.50/kg Lycra: \$10–\$12/kg (but only 2% usage)

- Blend Cost Impact: Raw cost increases \~\$0.20–\$0.30/kg over pure cotton.

- Processing Overhead: Stretch knitting adds \$0.10–\$0.20/kg.

- Fabric Pricing: \$4–\$7 per yard—premium stretch at minimal cost increase.

Blend Pricing and Properties

| Blend Type | Raw Cost (USD/kg) | Processing Overhead (USD/kg) | Fabric Cost (USD/yard) | Key Benefits |

|---|---|---|---|---|

| 65/35 Poly-Cotton | 1.30–1.85 | 0.20–0.40 | 3.00–6.00 | Comfort, durability, price balance |

| 80/20 Wool–Nylon | 6.80–10.40 | 1.00–2.00 | 8.00–15.00 | Warmth, abrasion resistance |

| 98/2 Cotton–Lycra | 1.70–2.80 | 0.10–0.20 | 4.00–7.00 | Stretch, fit retention |

Critical Perspectives

- Performance vs. Price Poly-cotton offers broad appeal for uniforms and home textiles; wool-nylon commands specialty-use prices—reserve for outerwear or hospitality blankets.

- Processing Complexity Dual-dye blending increases potential for shade variation—specify tight tolerances and sample approval processes.

- Sustainability Note Blends complicate recycling streams; consider mills offering take-back or chemical recycling programs.

- Consumer Perception Highlight blend benefits (“stretch-enhanced cotton”) to justify small price premiums in marketing materials.

Are Specialty Finishes (Waterproof, Flame-Retardant, Antimicrobial) Adding Significant Cost?

Specialty finishes can transform ordinary fabrics into high‐performance textiles, but they also add to bulk order pricing. Durable water repellents (DWR) add \$0.20–\$0.40 per yard, flame-retardant (FR) coatings \$0.30–\$0.60 per yard, and antimicrobial treatments \$0.25–\$0.50 per yard. When selecting finishes, ask whether the added functionality—protection from fluids, fire safety compliance, or bacterial control—is mission-critical for your end use, or if a simpler base fabric at lower cost may suffice.

Cost vs. Benefit of Common Finishes

Durable Water Repellent (DWR)

- Cost: \$0.20–\$0.40/yard for C6 fluorocarbon or silicone-based finishes.

- Performance: Hydrostatic head ≥1,000 mm; maintains breathability with <5% drop in air permeability.

- Use Case ROI: Outdoor workwear and awnings where occasional rain exposure justifies the premium.

Flame-Retardant (FR) Coatings

- Cost: \$0.30–\$0.60/yard for reactive or additive FR systems meeting NFPA 701 or CPAI‐84.

- Performance: Passes vertical burn tests with after-flame <2 s and char length <50 mm.

- Use Case ROI: Safety curtains, welding blankets, and protective uniforms—mandated by regulation.

Antimicrobial Treatments

- Cost: \$0.25–\$0.50/yard for silver‐ion or QAC finishes.

- Performance: ≥99% bacterial reduction (AATCC 100) sustained through 50–100 industrial launderings.

- Use Case ROI: Healthcare scrubs, hospitality linens, and gym wear where hygiene and odor control are priorities.

Combined Finishes

- Synergy Cost: Layering DWR + FR + antimicrobial can add \$0.80–\$1.50/yard cumulatively.

- Efficiency: Some mills offer multi-function finishes reducing add-on to \$0.60–\$1.00 for two properties.

Finish Cost and Functionality

| Finish Type | Cost (USD/yard) | Key Performance | Primary Applications |

|---|---|---|---|

| DWR | 0.20–0.40 | Waterhead ≥1,000 mm | Outdoor apparel, awnings |

| FR | 0.30–0.60 | NFPA 701 pass, after-flame <2 s | Safety gear, stage curtains |

| Antimicrobial | 0.25–0.50 | ≥99% kill rate post-50 washes | Medical scrubs, hospitality linens |

| Dual Finishes | 0.60–1.00 | Combined water + microbe or flame | Multi-service textiles |

Critical Perspectives

- Necessity vs. Luxury Only specify DWR for fabrics with real-world wet exposure; avoid adding FR to non-critical items just to “protect investment.”

- Finish Durability Plan re-treatment schedules—DWR may fade after 20 washes, antimicrobial after 50—factor life-cycle costs into pricing.

- Regulatory Drivers FR finishes often aren’t optional—compliance can carry heavy penalties, making the up-front cost unavoidable.

- Integrated Finishing Seek mills offering combined finishes to reduce handling and cost; validate that multi-functional treatments meet all individual performance standards.

How Does Minimum Order Quantity (MOQ) Vary Across Different Material Types?

MOQ requirements significantly influence per‐unit pricing, as higher MOQs allow suppliers to spread fixed setup costs over more yards. Natural luxury fabrics like silk and high‐end linen often demand MOQs of 2,000–5,000 yards per color, pushing unit costs higher for smaller runs. Commodity synthetics (polyester, nylon) can be produced in lots as low as 500–1,000 yards, while basic cotton and poly‐cotton blends often start at 1,000–2,000 yards. Blends with specialty finishes or nonwovens may have MOQs of 3,000–10,000 yards due to complex processing lines. Understanding these thresholds helps you balance inventory risk against unit‐price savings.

MOQ Implications by Fabric Category

Luxury Naturals (Silk, Premium Linen)

- Typical MOQ: 2,000–5,000 yards per color/width.

- Pricing Impact: Small runs (\<MOQ) incur surcharges of +15–30%.

- Strategy: Pool orders across seasons or SKUs to meet MOQ and avoid surcharges.

Commodity Synthetics (Polyester, Nylon)

- Typical MOQ: 500–1,000 yards.

- Pricing Impact: Volume tiers at 1,000, 5,000, 10,000 yards can drop unit cost by 5–15%.

- Strategy: Lock in larger, forecasted volumes to hit the most favorable tier.

Cotton & Blended Fabrics (Poly‐Cotton, Cotton‐Lycra)

- Typical MOQ: 1,000–2,000 yards.

- Pricing Impact: Surcharges of 10% on runs below 1,000 yards; 5% savings at 2,500+ yards.

- Strategy: Standardize base colorways and weights to consolidate small‐batch SKUs.

Nonwovens & Specialty Finishes

- Typical MOQ: 3,000–10,000 yards depending on basis weight and finish line scheduling.

- Pricing Impact: High surcharges (20–40%) for off‐batch, small runs.

- Strategy: Schedule finishes during mill’s campaign runs or share cost with co‐buyers.

MOQ and Pricing Tiers by Fabric Type

| Fabric Category | MOQ (yards) | Below MOQ Surcharge | Discount Tier at MOQ |

|---|---|---|---|

| Silk & Premium Linen | 2,000–5,000 | +15–30% | –5–10% at 5,000+ |

| Polyester & Nylon | 500–1,000 | +5–10% | –5–15% at 5,000+ |

| Cotton & Blends | 1,000–2,000 | +10% | –5% at 2,500+; –10% at 5,000+ |

| Nonwovens & Finishes | 3,000–10,000 | +20–40% | –10–20% at 10,000+ |

Critical Perspectives

- Inventory vs. Discount Larger MOQs cut prices but tie up capital and warehouse space—conduct an ABC analysis to decide which SKUs merit bulk buys.

- Shared Campaigns Collaborate with non‐competing brands to co‐finance specialty runs, splitting MOQs and cost benefits.

- Seasonal Demand Planning Align large orders with off‐peak mill schedules to further negotiate MOQ waivers or deeper discounts.

- Flexible MOQ Programs Some mills offer “starter” lines—e.g., 500-yard limited runs—at slightly higher prices, enabling sample testing before committing large volumes.

8. What Sourcing and Negotiation Strategies Can Offset Material-Driven Price Differences?

Even when raw material costs are high, savvy sourcing tactics can reduce landed costs. Strategies include consolidated volume purchasing, off‐peak scheduling, vendor‐managed inventory (VMI), and long‐term agreements with built‐in performance incentives. By leveraging commitments—such as guaranteed annual volumes, forecast sharing, or multi‐year contracts—buying teams can negotiate 5–15% price reductions, flexible MOQs, and prioritized capacity.

Effective Procurement Tactics

Consolidated Volume Purchasing

- Approach: Combine orders across product lines or seasons to hit higher volume tiers.

- Benefit: Unlocks tiered discount structures, often 5–10% lower unit costs.

Off-Peak Production Scheduling

- Approach: Schedule bulk orders during mills’ slow seasons (e.g., first quarter).

- Benefit: Mills offer 5–8% off peak‐season rates to fill capacity.

Vendor-Managed Inventory (VMI)

- Model: Supplier holds buffer stock on your behalf, replenishing as you consume.

- Benefit: Reduces stockouts, spreads MOQ commitments, and can include cost guarantees.

Multi‐Year Contracts with Incentives

- Structure: Commit to annual volumes with performance bonuses tied to quality and on‐time delivery.

- Benefit: Suppliers lower prices in exchange for forecast visibility and volume certainty.

Collaborative Product Development

- Tactic: Co‐design fabrics and finishes with mills to optimize processing steps and raw‐material use.

- Benefit: Shared R\&D costs yield innovative, cost‐efficient materials tailored to your needs.

Sourcing Strategies and Expected Savings

| Strategy | Mechanism | Expected Cost Reduction |

|---|---|---|

| Volume Consolidation | Aggregate orders | 5–10% |

| Off-Peak Scheduling | Production in slow season | 5–8% |

| Vendor-Managed Inventory | Supplier-held buffer stock | 2–5% |

| Multi‐Year Contracts | Volume & performance commitments | 3–7% |

| Collaborative Development | Joint R\&D and process optimization | 5–10% |

Critical Perspectives

- Risk Sharing vs. Flexibility Long‐term agreements secure pricing but may limit agility—build in exit clauses or volume flex options.

- Supplier Relationship Management Treat mills as partners: transparent forecasting and shared goals drive deeper collaboration and better pricing.

- Technology and Data Analytics Use procurement analytics to track spend, supplier performance, and forecast accuracy—identify negotiation levers with data evidence.

- Sustainability and CSR Integration Brands committing to sustainable practices can often negotiate better terms if they offer mills visibility into eco‐initiatives and co‐branding opportunities.

Ready to streamline your fabric sourcing and secure the best bulk pricing?

Material choice can make or break your bulk‐order budget—from the premium allure of silk to the cost‐saving efficiencies of polyester, each fabric category brings unique price drivers. By understanding raw‐material costs, processing expenses, MOQ impacts, and effective negotiation strategies, you can optimize your fabric sourcing to hit both quality and margin targets.

- Request tailored quotes on natural, synthetic, blended, or nonwoven fabrics

- Explore collaborative product development with Szoneier Fabrics for cost‐optimized materials

- Leverage our low‐MOQ prototyping and rapid sample service for quick decision‐making

Contact Szoneier Fabrics today to start cutting costs—without cutting corners.